Choosing Confused.com

© Confused.com

If you want to save money, save time comparing and be able to get covered in under 10 minutes then maybe Confused.com is the site for you. Find out more with our quick guide.

Home Insurance

Home insurance is pretty vital whether you own your own home or are renting. There are a number of different ways to insure your home including buildings, contents and some insurance companies offer combined policies. Buildings insurance will cover you for all the parts of your home that are fixed, e.g.. walls, roofs, ceilings. They could be affected by flooding or storms. Most mortgage lenders will not lend to you without buildings insurance being in place so for home owners this is vital. Contents is all about insuring those items that can be easily removed from your home e.g.. jewellery, works of art, electrical items. If you are renting an unfurnished property this is really important to you. A combined policy is really designed for those who own their own home and as you would guess they cover you for both contents and buildings.

Shopping around for the right home insurance is really worth it. Why? Well it could save you a good amount of money for a policy that offers the same features as a more expensive one. Confused also advise on other ways to reduce the levels of home insurance that you pay including increasing your excess (this is the contribution you have to make when you make a claim) and also try and accurately assess the value of what you own. If you overestimate the value of your possessions you will only have to pay greater insurance costs. Finally, it can also be cheaper to pay in one instalment than monthly by direct debit, so if you can afford this then it is worth considering.

Before you go on line with Confused do have the following information to hand-the date your home was built, whether you have window locks or an alarm, the date you moved in, the cost to rebuild your home and the total value of your personal belongings.

+ Click here to Compare Home Insurance

Car Insurance

How much you pay in car insurance depends on a number of factors. These include the type of car you drive, who drives the car, where you live and how you use the car. So smaller cars cost less to insure than larger ones and possessing a car alarm or immobiliser can bring down the cost of your car insurance.

It is also important that you select the right type of car insurance. The different types of cover include third party, third party fire and theft and comprehensive. If money is tight third party can be good but remember it will only cover claims by other parties, it won’t cover any damage to your car. Third party fire and theft adds fire and theft cover to the car. Comprehensive as the name suggests covers any damage to your car and someone else’s. It is worth shopping around on Confused for a good value comprehensive cover.

To reduce the amount of car insurance you pay use your voluntary excess to lower your premium, this is the contribution you make towards a claim and if you can park your car in a driveway or garage overnight, this alone will reduce your premiums.

When shopping around on Confused have to hand the following information-reg number of the car, details of any no claims bonus, driving license, previous accidents or claims and the details of any other drivers who will be using the car.

+ Click Here to Compare Car Insurance

Travel Insurance

Travel insurance isn’t just about helping you if you are ill or have an accident on holiday. It is a vital part of any holiday that you take as it also covers you in case of delays and lost luggage. And for skiing holidays its is more than essential as a ski accident could end up costing you thousands if you have the wrong cover.

The different types of travel insurance include single trip cover and annual cover. Single trip is good if you plan to do just that, take the one holiday. All you will be asked for is how long your single trip will last, with departure and return dates. Annual is better if you are planning a number of holidays over a year and many include all domestic trips. But do beware, there will be a limit to the number of days you can be away, so check out the detail. Many standard policies cover you for up to 31 consecutive days but some are as short as 24 days. If you are skiing also check that your travel insurance includes this, if it doesn’t top it up with specialist cover.

When you are looking for travel insurance you will be asked whether you have a pre-existing medical condition. Any medical condition that you know about before you take the policy out is a pre-existing medical condition. If you don’t declare this then that could invalidate your policy. Some conditions do make it hard to get good travel insurance but on Confused you can search those insurers who will insure you with conditions like high blood pressure and heart disease.

+ Click Here to Compare Car Insurance

Using Confused.com

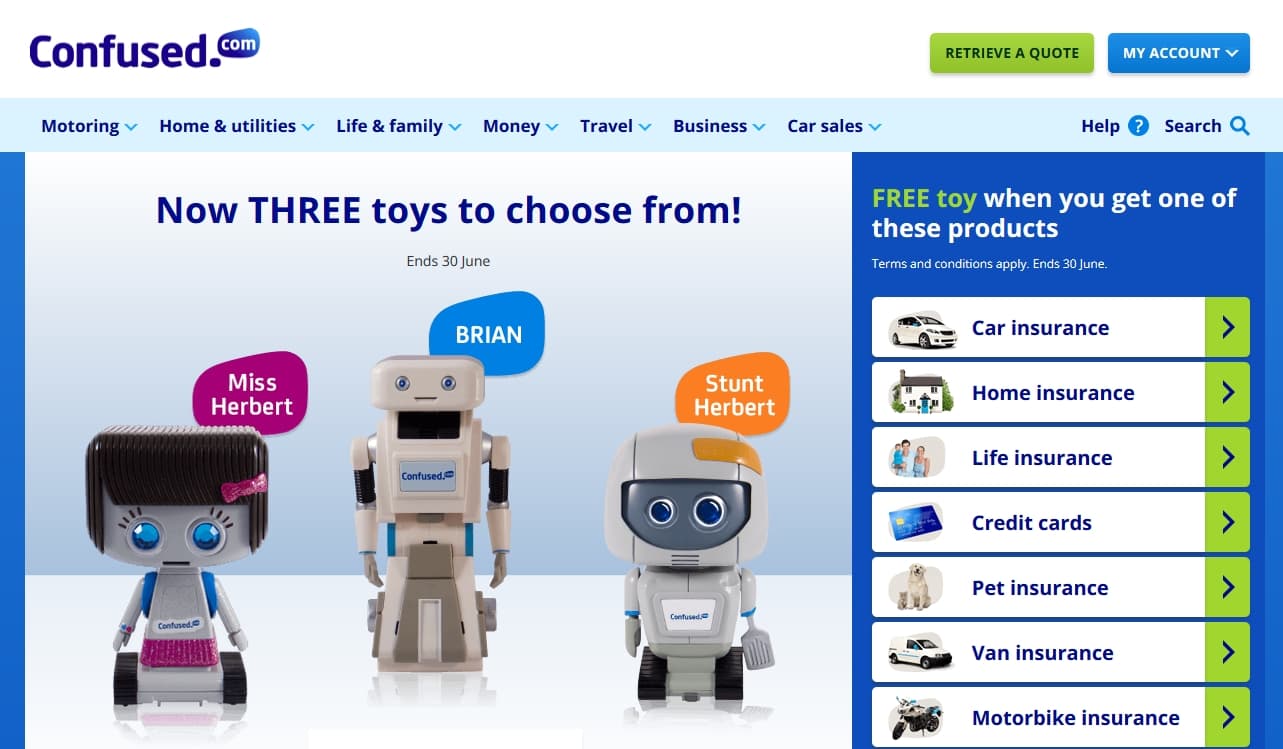

Using Confused.com will undoubtedly help save you money on your insurance and insure that you get policy that is right for you. In addition you could also get a robot toy-the stunning ‘Brian, Stunt or Miss Herbert. Great for you or the children, could be a marketing gimmick but they seem to be working!

Useful Links

Go to Confused.com - www.confused.com

Confused.com - Home Insurance - www.confused.com/home

You Might Like

Choosing The Right Travel Insurance

If you want to look and compare travel insurance policies online, make sure you get the best quote and sign up right there and then, check our guide to get the essentials right.Get The Best Car Insurance Quote

Why not find out about car insurance quotes online with the help of our quick guide including Third Party and comprehensive cover.Choosing The Right Home Fitness Equipment

If you're choosing the right fitness equipment for your home, then you'll be able to workout anytime and for however long you want! Read our guide now to save money.Car Insurance For Young Drivers

Car insurance for young drivers can be very expensive, find out how to save money whilst getting the best policyChanging Your Car Insurance Provider

Want to know how to change car insurance providers in order to save money? It may seem a daunting task, but read our quick guide to see what you need to do.

Useful Websites

- Home And Household Insurance

Home inurance, including all buildings and contents. - Skyscanner.net

Find the cheapest flights fast, as well as hotels,car hire and holiday deals. - Confused.com Home Insurance

Making sure your home is covered for every eventuality, home or house insurance should be a comprehensive affair. Get quotes and compare cover with Confused.com - the specialists. - Winter Sports Insurance

Compare winter sports insurance cover online to get a great deal before you go skiing or snowboarding. From Europe to North America, single trip to multi trip cover, start here. - Direct Car Excess Insurance

When you hire a car, the rental price usually includes insurance to cover you for accidents and theft. But, if your car is damaged or stolen, you'll have a large excess to pay - not with this policy! - Decision finance Business Insurance

Working with a panel of leading business insurance brokers get a free quote for insurance cover tailored to the needs of your business. - Add Your Website Here