How Does A Guarantor Loan Work?

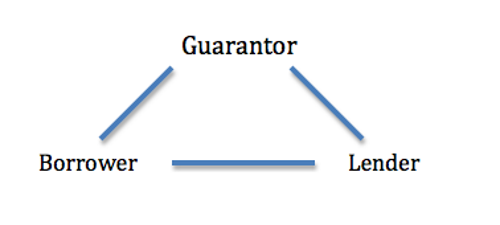

A guarantor loan is similar to the way a borrower asks a lender for money but the only difference is that there is someone else involved who ‘guarantees’ to cover the cost of the loan if the borrower defaults.

So if the customer is unable to make the monthly repayment, the collection is automatically taken out of the guarantor’s debit account by the lender.

The person who acts as the guarantor is usually a family member, friend, colleague or spouse. This person usually has a close relationship with the borrower and has an understanding of their current financial situation. The guarantor must have full consent before agreeing to be involved in the loan agreement. They will be responsible to cover the cost of the loan so it is important that the guarantor is also in a financial position to repay the loan if the borrower is unable to do so.

The person who acts as the guarantor is usually a family member, friend, colleague or spouse. This person usually has a close relationship with the borrower and has an understanding of their current financial situation. The guarantor must have full consent before agreeing to be involved in the loan agreement. They will be responsible to cover the cost of the loan so it is important that the guarantor is also in a financial position to repay the loan if the borrower is unable to do so.

A good guarantor to have is someone with a good credit history and a good track record of paying other credit cards and loans. The lender feels that having a guarantor with good credit to cover the borrower’s repayment poses little risk. For this reason, borrowers that have guarantors with good credit ratings are far more likely to be accepted.

There are several guarantor loan lenders in the UK that allow customers to borrow up to £7,000 for up to 5 years. Examples of the biggest guarantor lenders in the UK are Amigo and Glo. With dozens of different guarantor loan providers, there are websites where you can compare guarantor loans to find the best deal. Each lender offers a different rate and some are able to provide same day funding and no early repayment fee if you wish to clear your debts early. You may not require the loan for as long as 5 years so having an option to repay early at no extra charge is a very good selling point.

Why A Guarantor Loan Is Good For People With Bad Credit

A guarantor loan can help those individuals who have a bad credit rating who have been rejected by other lenders and financial institutions. Typical payday lenders or high street banks require good credit ratings in order to be successful for a loan.

However, with a guarantor loan, the lender feels that they can trust the borrower if they have the trust of a guarantor with a good credit rating. Many lenders follow the motto of “if the guarantor trusts you then we do too.” So this gives a bad credit customer access to affordable finance that they would not get elsewhere.

The best thing about a guarantor loan is that if you repay on time, it will boost your credit rating. So the customer, who previously had bad credit, can prove that they are a good customer and rebuild their credit profile. A better credit rating will make it easier for that person to access finance in the future at more affordable rates.

As explained in "The guide to understanding guarantor loans" from guarantorloancomparison.co.uk, some customers have been unlucky to have bad credit. Perhaps they have had an emergency expense or they have had problems getting paid on time at work. At least a guarantor loan offers a very reasonable interest rate and a logical way to improve one’s credit score.

The Checks Done By Guarantor Lenders

The application for a guarantor loan is completely online and the customer will be asked to fill in details about themselves and their guarantor and if successful, they will be asked to co-sign the loan agreement. Each lender has their own algorithm to run a series of checks prior to granting a loan to a customer.

Credit checks are the most common checks carried out by lenders. A credit check is run on the borrower and the guarantor to assess how well they have repaid other types of credit and loans in the past. Based on this, the lender is able to get an idea of how likely the borrower or guarantor will be able to repay the loan. The lenders typically work with credit reference agencies so by performing a search on someone’s credit, they have access to all other loans they have made in the past. In the same way, the lender will report back to the credit reference bureau whether the loan has been repaid or not and this will cause their credit score to change. As mentioned above, repaying the loan on time will improve the credit rating of the customer but failing to repay will cause the credit score to decrease. So if a customer has defaulted on a loan and tries to get another loan elsewhere, the credit checks will show that they have missed repayment on a different loan and therefore be unlikely to proceed.

Other important checks include affordability measures to match how much the borrower wants to take out and how much they can afford to repay without going into arrears. Simply because a customer wants to borrow the maximum amount of £7,000 doesn’t mean that they are in a financial position to do so. The lender has a responsibility to ask questions about the customer’s salary, work position and monthly expenditure in order to gauge just how much they can afford to borrow each month. Typical affordability checks include asking for bank statements and pay-slips to confirm employment and salary. A failure to carry out credit checks will cause the borrower to possibly receive too much money and then struggle to make the monthly repayment and lead to financial difficulties.

How The Repayment Works

Repayments are made on a monthly basis in equal monthly instalments. But since a guarantor loan can last up to 5 years, most lenders will allow you to repay early with some charging a fee and others offering no early repayment fee. If a customer misses repayment, they will usually receive a phone call and email from the lender to discuss repayment. They may be able to create a pay plan or an arrangement with the lender to lower the monthly fee but pay over a longer period of time.

If the borrower does not respond to any of the lender’s communications, the payment will likely be taken automatically from the guarantor in order to cover the cost. This will negatively impact the credit score of the borrower for missing repayment. It is therefore advised to only take out a guarantor loan if you have planned how you are going to repay and failing to do so could lead to payment difficulties.

You Might Like

Guarantor Loans For Those With Bad Credit

Do you suffer from bad credit? Struggling to get any finance? Consider a guarantor loan to help you get started again.How Does Car Financing Work?

Car financing is an option when buying a new car, find out how it works in this handy guideWhy Have A Credit Card?

Why would you choose to have a credit card? Choosing the right one for you is more important than ever with debt and your credit rating at stake.What Does Consumer Credit Cover?

Do you need help with explaining what consumer credit is actually all about? Our consumer guides will help you understand and also give you some help where it's needed with your reports and checks.What Is A Collateral Loan?

Want to borrow money? Thinking about a loan? Have you heard about a Collateral Loan as one option?

Useful Websites

- Confused.com

Discover cheap insurance, loans, mortgages and credit cards with ease. You can even switch your utilities with their comparison service. All major providers - plus you get a robot toy to boot! - Cash Lady

CashLady is a short term loan service provider in the UK offering payday loans, cash loans and small installment loans. - Logbook Calculator

Borrow money with your car as the security regardless of your credit rating. Log Book Loans have increased in popularity in the UK, so check our site out to see what you can borrow now. - Car Cash Point

Withdraw the cash from your car including prestigious and vintage cars. - Lending Expert

Visit Lending Expert for comparison and expert advice on cheap loans, mortgages and finance. - Best UK Loans

Shop around for the best personal loan rates. Secured and unsecured loans for any purpose including home improvements, new car or holiday. - Add Your Website Here